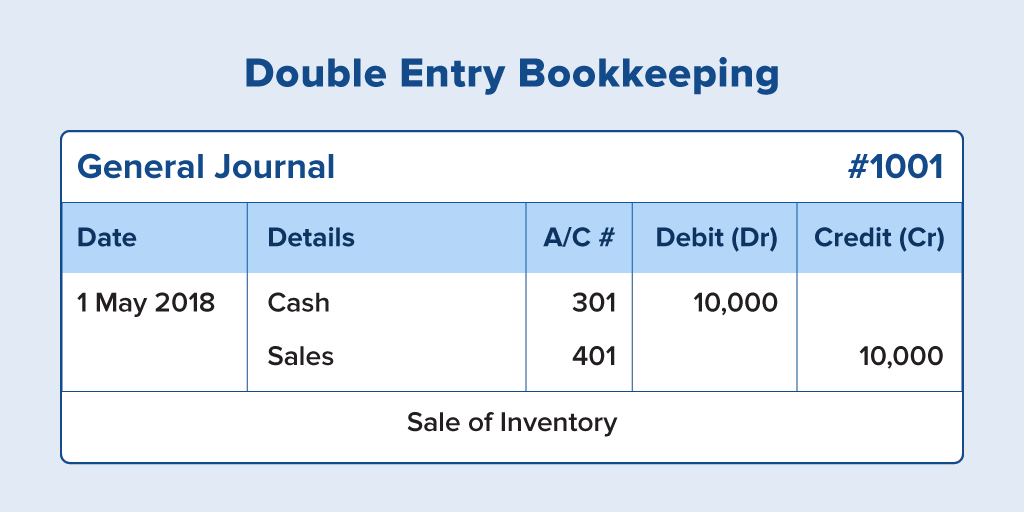

Double Entry is a method of accounting in which every transaction affects two accounts equally and correspondingly. That means one account’s value will increase and another account’s value will decrease at the same time.

For example, an accounting firm purchases office furniture. A transaction is recorded for this purchase where the accounting firm pays cash and the furniture store delivers the furniture. So, from the firm’s perspective, the cash account’s value decreases and the furniture account’s value increases.

This method of making two entries for every transaction (Double Entry System) makes accounting more reliable and accurate.

Books

One solution for your accounting and GST filing needs